Pionex Arbitrage Bot: Your Smart Investor

Cryptocurrencies and their blockchains are all based on algorithms: clear sequences of calculations, depending on user input. Unlike trading with shares, trading with cryptocurrencies was only possible digitally right from the start. Quite obviously, analog trading of the digital currency would be simply inconceivable. These circumstances imply that automated trading is also easier to implement, which is why trading bot providers popped up like mushrooms. This article takes a closer look at the Pionex arbitrage bot and shows step by step how you can use it yourself.

In my post Funding Rate: Is This Free Money? I covered the basics of perpetual futures arbitrage in detail. There I showed how you can use the trading strategy manually without leverage. By using a trading bot, you are able to maximize the returns of arbitrage futures spot trading.

What is a trading bot?

With all the euphoria regarding cryptocurrencies and the demands of small investors to get a piece of the pie, various providers of trading bots formed. These trading applications are supposed to execute predefined strategies based on algorithms.

An example: Buy the dip

The instructions of such an algorithm, expressed in very reduced terms, could be as follows:

- If the price of BTC drops by 10% within 30 minutes, then buy 1 BTC.

- And if after that the price rises 5%, then sell 1 BTC.

- Or if after that the price drops another 2%, then sell 1 BTC.

- Repeat.

The specific instructions reflect, in a simplified way, the Buy The Dip trading strategy. As with many trading bots, its goal is to exploit the volatility of the market.

In the above example, it is assumed that after a significant fall in the price within such a short period of time, the market will recover by at least half of this decrease, and thus the purchased BTC can be sold higher. Anyhow, it is thought that this will be the case more often than the market will fall significantly again after such an event. Via the second instruction, in which the purchased 1 BTC is to be sold in case of a further price drop by another 2%, one thus reduces the risk of losses.

Of course, it can take a while until a bot starts trading given the parameters defined above. A 10% drop within half an hour does not happen every day or week. Various parameters of a trading bot can be adjusted by the user. So a 5% drop in price within 6 hours would also be possible.

Don’t get stressed

After executing a full round of instructions, the bot again waits for the price to drop by the specified percentage within the defined time and then executes the deposited orders.

And you sit back and let them do the work.

Sitting back after starting a bot is actually enormously helpful. When investing, you easily get into gambling and the fear of missing out says hello every now and then also. For this reason, it is good to get rid of the emotions. A trading bot provides relief in this respect: the strategy is clearly specified and there are no ifs and buts.

Pionex, my favorite

Besides the Pionex arbitrage bots, I have also tried various algorithms from other providers. These often differ in the complexity of usage and in the pricing model. I see Pionex as the ultimate candiate for both beginners and professionals. It is very easy to use and the fees are much lower compared to big trading platforms like Binance.

Besides starting trading bots, cryptocurrencies can be traded manually on Pionex. When trading, only a minimal fee of 0.05% is charged. The same percentage also applies when trading bots execute your orders. Unlike other trading bot providers such as Coinrule, Pionex does not charge a monthly fee.

Create your account on Pionex here

and benefit from the lowest trading fee of 0.05%.

Pionex arbitrage bot in detail

Pionex offers various trading bots, which I will discuss in future blog posts. One of them is the trading bot, which uses the example algorithm from above. However, this post will go into more detail about the Pionex arbitrage bot, which takes advantage of the price difference between perpetual futures and spot market.

Using the bot is really easy as pie and you should be able to start one with this post alone. Nevertheless, as with all investments, I recommend getting to grips with the basics of the trading strategy first. Because only when you really know what the bot is doing, you can sit back and relax. So if futures trading, the contango price situation or the funding rate in perpetual futures mean nothing to you, then I recommend you read my articles about them:

- Futures contracts for dummies – a simple explanation

- Contango: Your Chance for a Low-Risk Profit

- Funding Rate: Is This Free Money?

But if you want to start quickly and don’t care about the basics, then no one should stop you 🚀

Manual vs. automated arbitrage trading

There are several advantages of using a trading bot to exploit the price difference between spot and futures markets. On one hand, smaller risks are eliminated compared to manual trading and on the other hand, the algorithm can maximize the profit by using levers.

1. Handling

The execution of the trading strategy requires three steps:

- Buying the asset in the spot market.

- Transfer the purchased asset to the futures wallet.

- Opening the short position.

If you perform these steps manually, there may be price fluctuations between step 1 and step 3. Your investment will be in a neutral position only after executing step 3, in which the platform will credit you with the funding rate of 0.01% every 8 hours. If the price of the asset drops after buying it in the spot market, it may well be that a you incur a loss until the short position is opened. Since the Pionex arbitrage bot executes all three instructions within milliseconds, this risk no longer exists under its application.

2. Return on investment

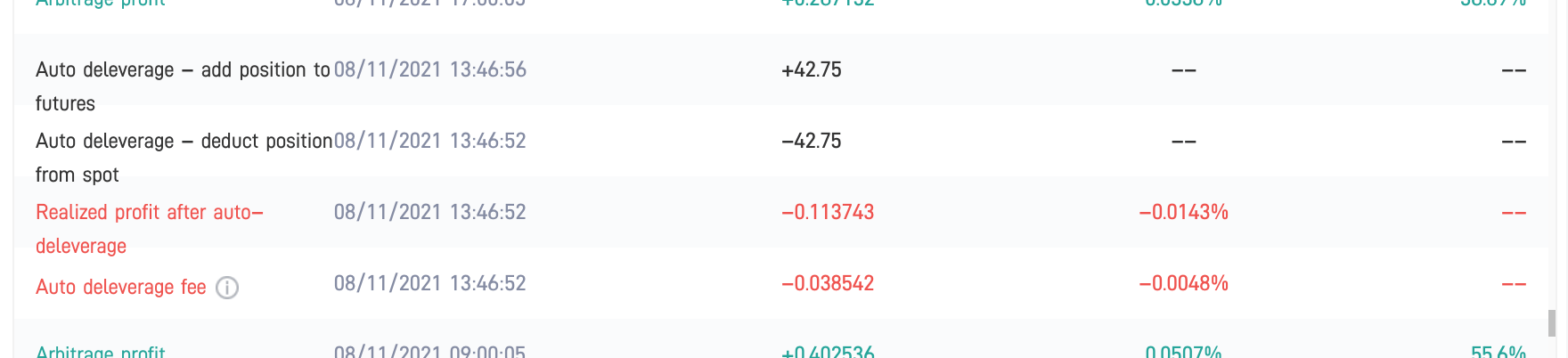

In order to be able to sit back and relax in manual arbitrage trading, it is recommended not to use leverage. Because when using leverage, the investor must always make sure that the loans used for it are covered in the event of major market fluctuations. The Pionex arbitrage bot, on the other hand, organizes your positions in such a way that you can use a double or triple leverage with low risk and expect a higher return as a result. The following example shows how the trading bot handles a margin call and ensures that the leverage is covered. Only a minimal fee is charged when the investments are switched from spot to futures market.

4. Currencies

Depending on the trading bot provider, there are a variety of currencies that can be used for futures spot arbitrage trading. The only negative point I see is that many providers force the usage of Tether for intermediate transactions. Accordingly, other stablecoins like USDC or BUSD are less common. In my post Bitcoin Collapse – When Is This Bubble Going to Pop? I described how Tether acts as the blood of the entire crypto market and why I am very skeptical about the currency. However, due to the potential of such a trading bot, I am willing to bite the bullet.

And what does the return using Pionex look like concretely?

Let’s get down to the nitty-gritty. The funding rate and the associated potential return on investment of a cryptocurrency can be viewed at any time. Depending on the current demand, the expected return on investment is higher, as the funding fee to be received is higher when the currency is shorted.

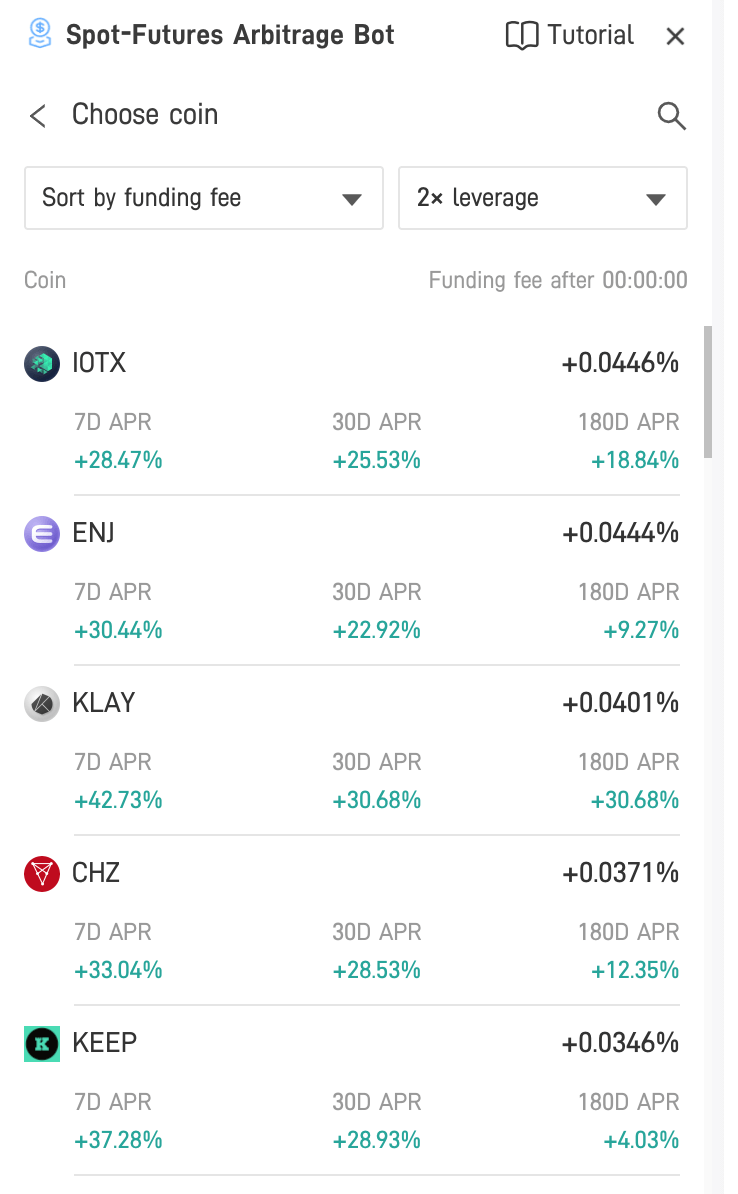

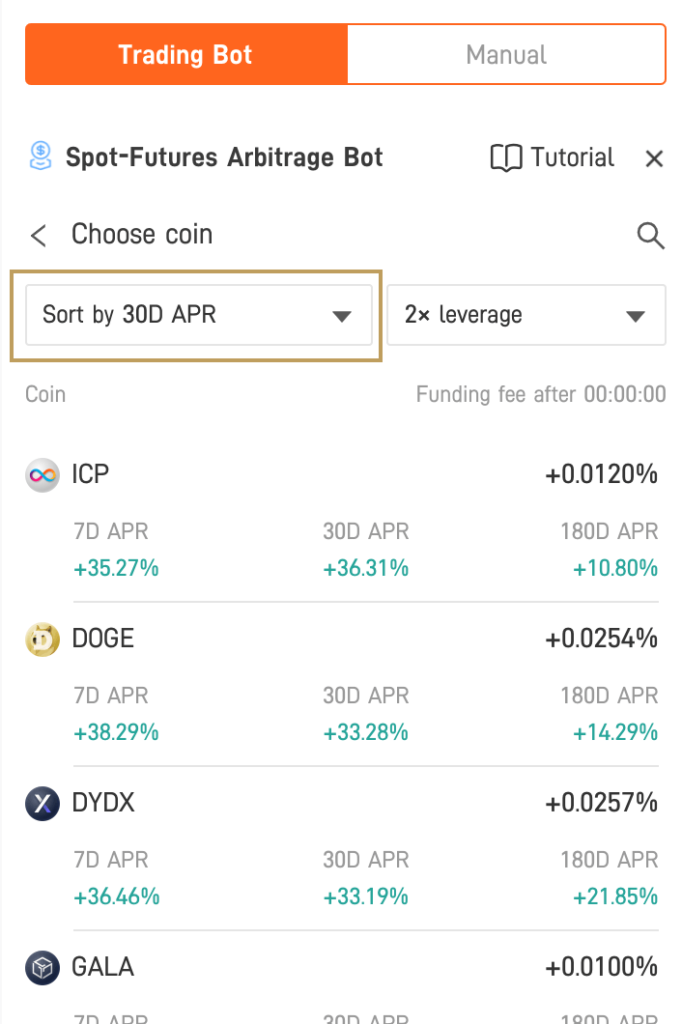

The following screenshot shows the cryptocurrencies sorted by current funding rate in descending order. At the current time, IOTX shows 0.0446% return every 8 hours.

The chart also shows that 2x leverage is selected. This has an impact on the long-term performance. Over the last 7, 30 or 180 days, this long-term performance is shown by means of 7D APR, 30D APR and 180D APR.

Yield based on past performance

Since there is a fee charged each time a bot is started or stopped, it is not recommended to switch too often just to get the best funding fee at the time. If you look at the funding rate of the top coin, an annual return of 48% is very tempting (0.0446% * 3 * 365). However, since the rate changes daily or hourly and therefore it is absolutely unrealistic that the reported 0.0446% will last for a year, it makes much more sense to look at the performance of the last 30 days.

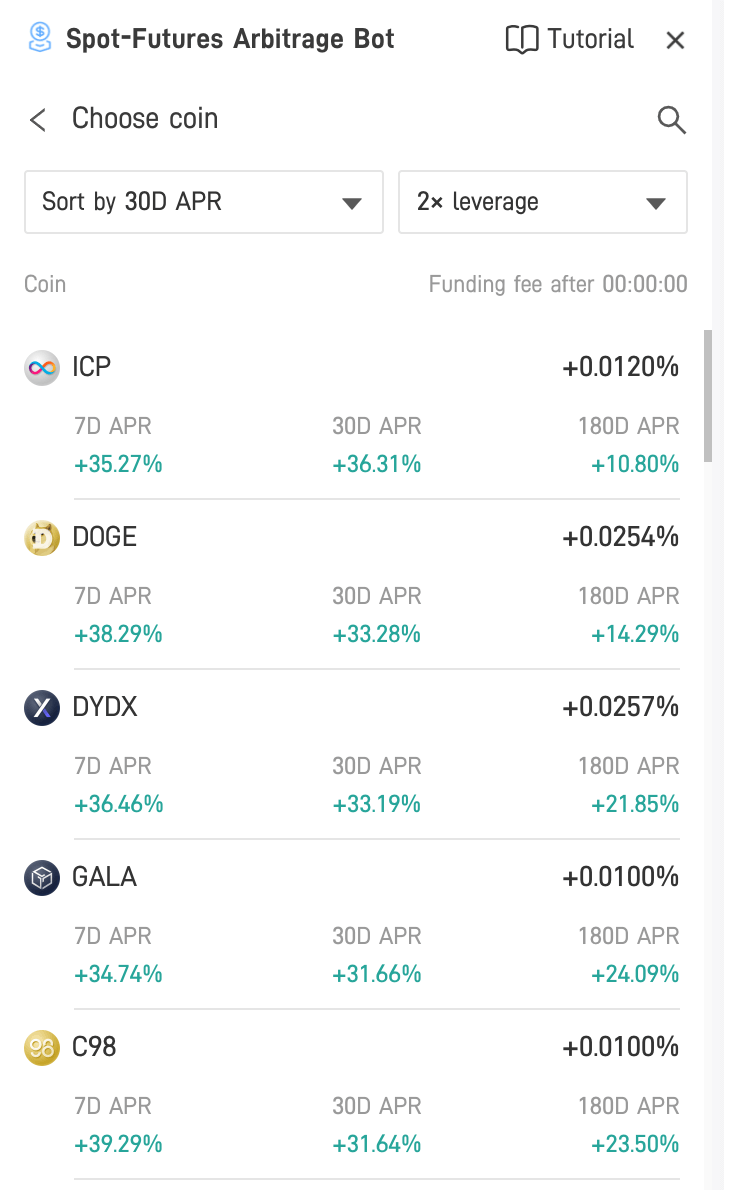

With the intention of running the Pionex arbitrage bot for a few weeks, the situation is much different. According to the screenshot, ICP and DOGE are more suitable.

Caution: Past performance is no guarantee of future performance. For this reason, it makes sense not to put all your eggs in one basket. Starting several bots with different coins therefore makes sense.

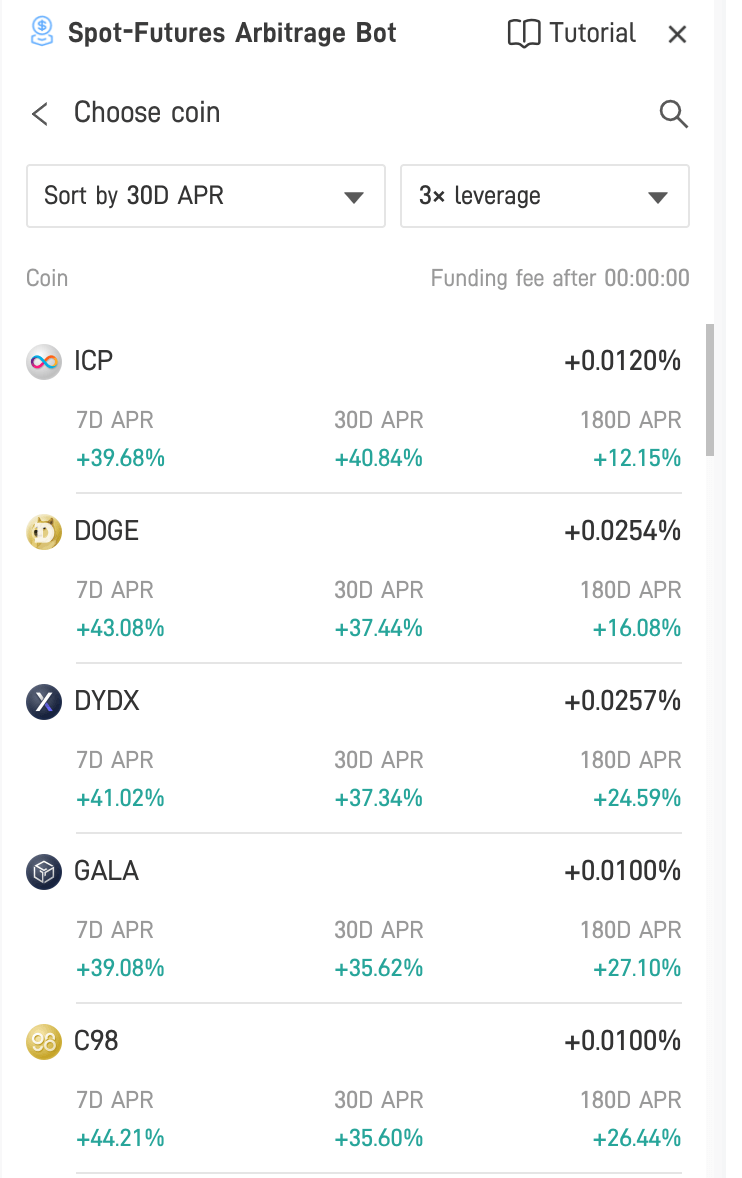

Trading bot on steroids with 3x leverage

If you now additionally decide for a triple leverage, then the return looks a bit different again.

According to the screenshot, a Pionex arbitrage bot with ICP would have generated an annual return of 40.84% over the last 30 days with triple leverage. But again, you can’t necessarily expect the same performance in the future. If the funding rate slips into the negative, this also means that your temporary return slips into the negative. In this case, the leverage also amplifies your loss.

Fortunately, during my active time on Pionex, such a state lasted no more than two days at a time. In this case, it is worthwhile to observe the bot and stop it if necessary. However, I recommend not to act too emotionally driven here, as well. Due to the fee, which is incurred when starting a Pionex arbitrage bot, it is worth waiting a few days until the return becomes positive again, rather than constantly starting new trading robots.

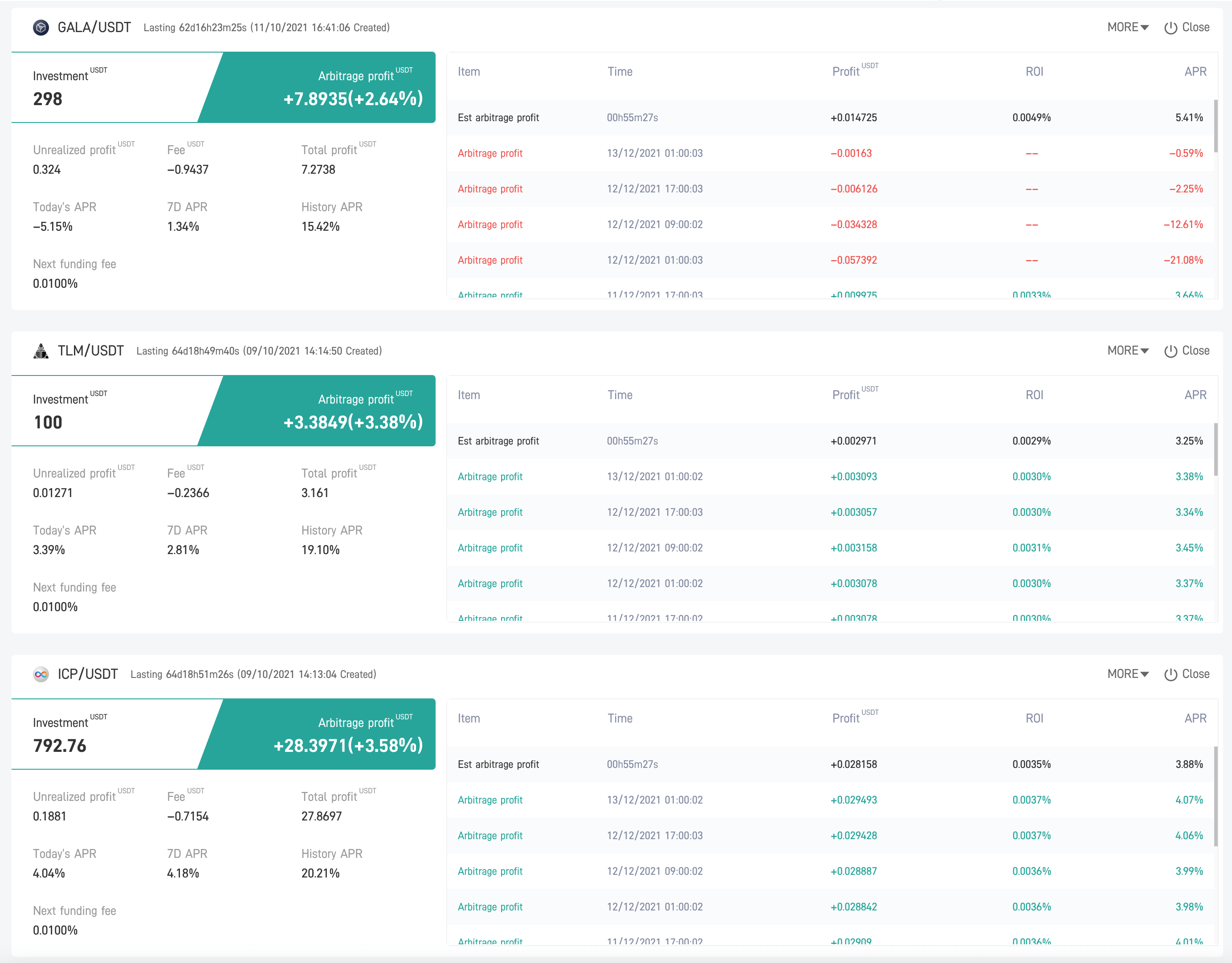

My babies

In the meantime, I have already started three trading bots on Pionex. Over a period of about two months, the following picture emerges.

The three bots show a profit of ~40 USDT on 1190 USDT invested capital. This results in a total return of 3.36% within two months. If you extrapolate this percentage, you get an annual interest of about 20%.

This calculation should also be taken with a grain of salt. We had an incredibly euphoric summer and the mood in the crypto market currently is somewhat depressed. If you look at the interest rates of the current day («Today’s APR») in the screenshot, they are only 4% or even -5%. The trading bot with the GALA currency has been running relatively poorly since yesterday. Therefore, the rule applies: observe and, if necessary, close the bot after a few days of negative profit.

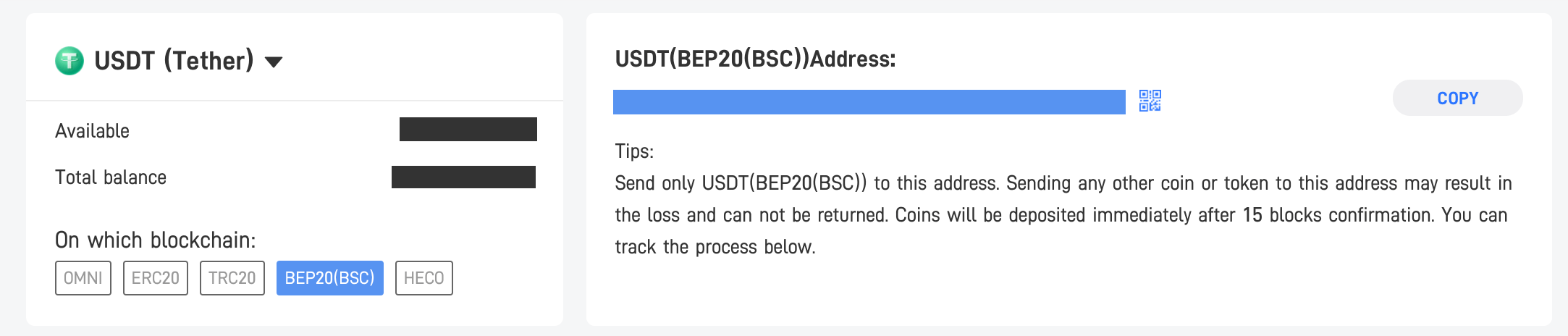

Hands On: Start your own Pionex arbitrage bot

If you haven’t created an account on Pionex yet, then what are you waiting for? go to Pionex. Done? Ok. Then let’s transfer USDT to your Pionex account. If you have a Binance account, you can make the transfer via Binance Smart Chain to reduce the transaction cost to 0.8 USDT.

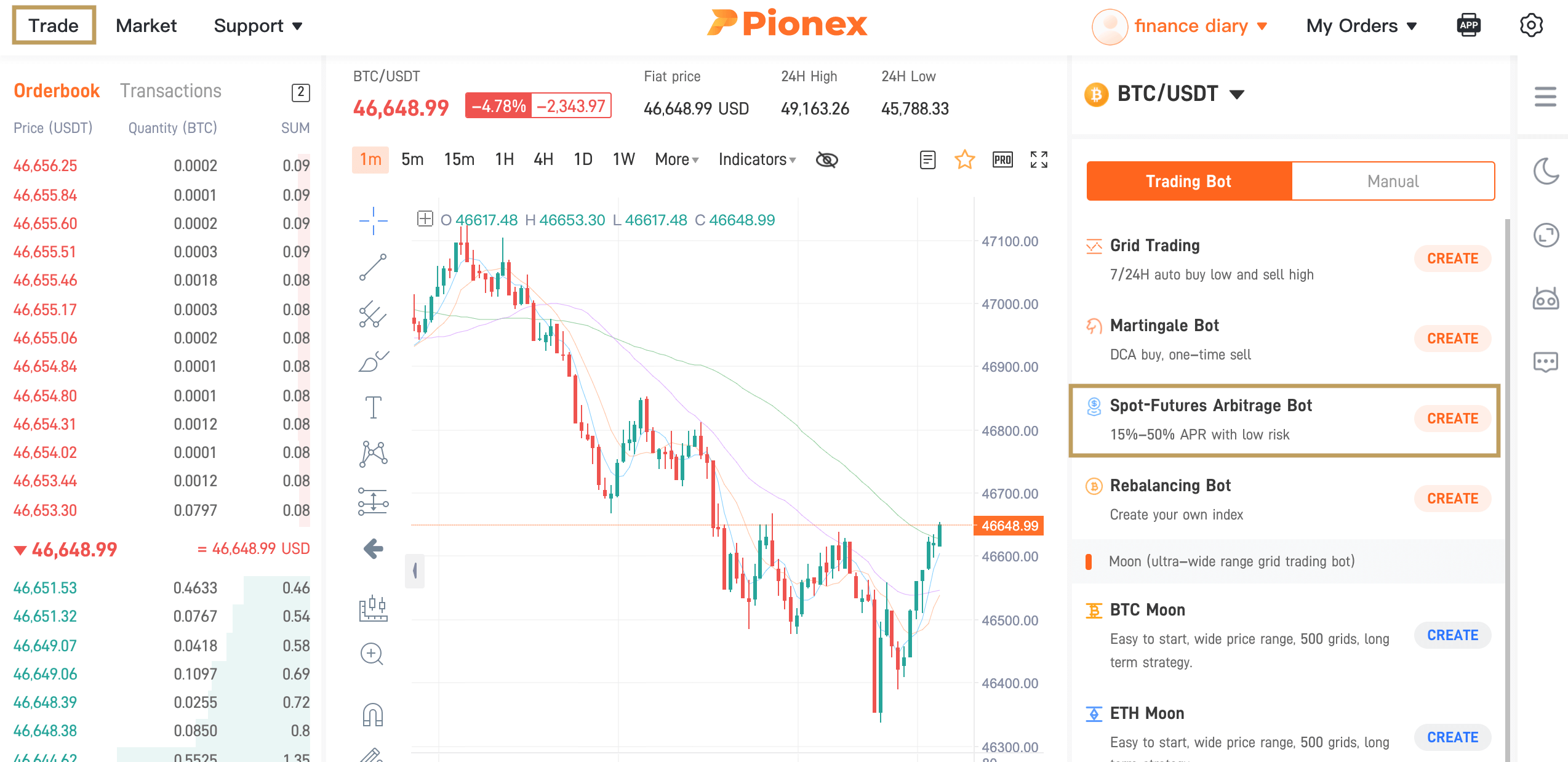

If you have appropriate funds in your Pionex account, click on «Trade» in the navigation and then select the «Spot Futures Arbitrage Bot» (framed in golden in the screenshot).

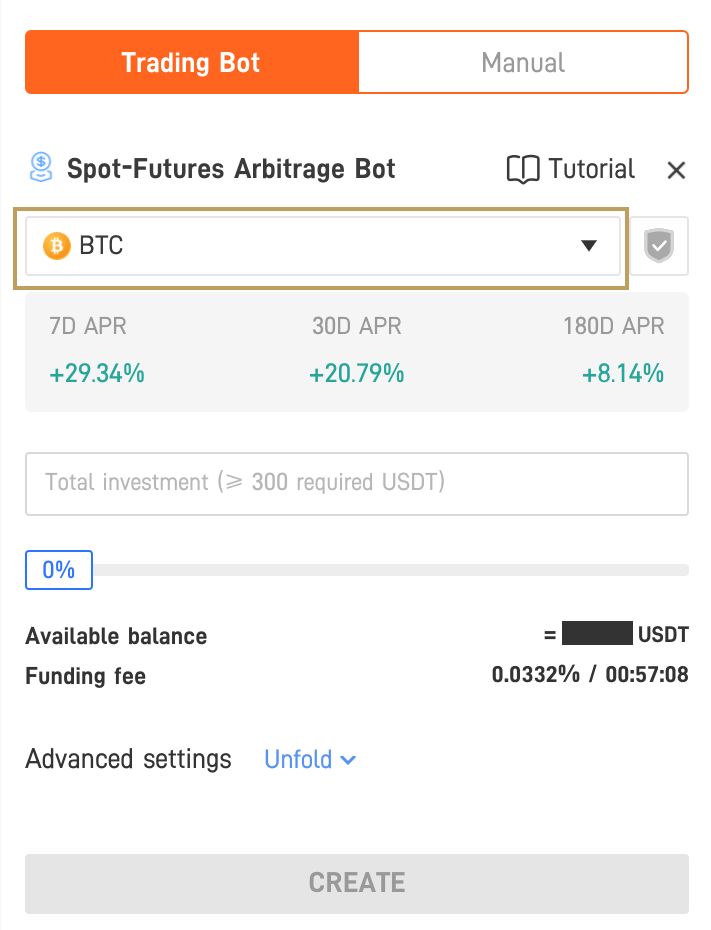

After that, choose a coin that has a promising return based on its past performance. Therefore, as described above, sort the coins by 30D APR.

Then click on the coin you want to start with and enter your capital to be invested. Now nothing more stands in the way of your return.

Pionex arbitrage bot ✔️ And what’s next?

Monitor your arbitrage trading bots every now and then and enjoy the funding fee that Pionex credits you over time.

As you can see in the Pionex view above, there are several other trading bots: Martingale Bot, Grid Trading, Reverse Grid Trading, just to name a few. Of course, I’ve been trying these as well, as I’m constantly looking to expand my understanding. Posts will follow, so stay tuned! 🤖